Table of Contents

In an interview with Kyla Scanlon, the NYU professor, entrepreneur, and author Scott Galloway gave a very straightforward and foundational definition of wealth. He said:

I find the definition of Wealth is: Passive income that’s greater than your burn… Just on a very basic level.

And that means my father is wealthy, because between his Royal Navy pension and Social Security he gets about $48,000 a year and he spends $38,000…

My dad is the world’s cheapest man. We went out for Mexican food, he’s 93, and he orders the same thing and a margarita and he has a few sips of his margarita and he asks (no joke) for the margarita to go… So we take home a half drink margarita!

But he is rich. He is 93 and still saving money.

And then I have friends who run large divisions of investment banks that make between 3 and 7 million a year (depending upon the year). And between their ex-wife, their alimony, their home in the Hamptons, their “Master of the Universe” lifestyle they spend all of it! And I can tell you firsthand they sit awake at night, a lot of nights, staring at the ceiling really worried…

So, [the definition of wealth is] passive income that’s greater than your burn! And that’s kind of how you sort of figure out your retirement number…

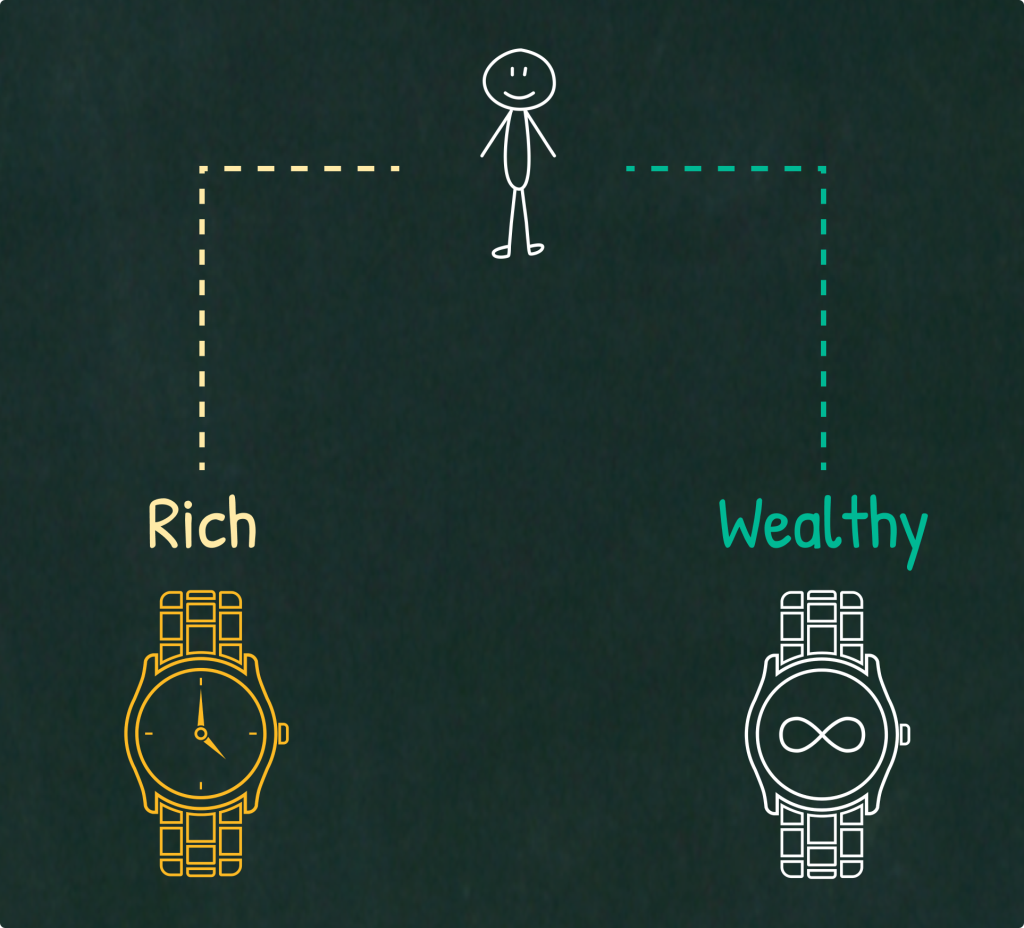

I couldn’t have put it better myself. Just from this definition, we can already see the difference between rich and wealthy. Sometimes these terms “rich” and “wealthy” are used interchangeably, but what matters is not so much the terminology as that you understand the fundamental difference between people that just look rich and people who are truly rich (or wealthy) — what I’ll call TRW for short.

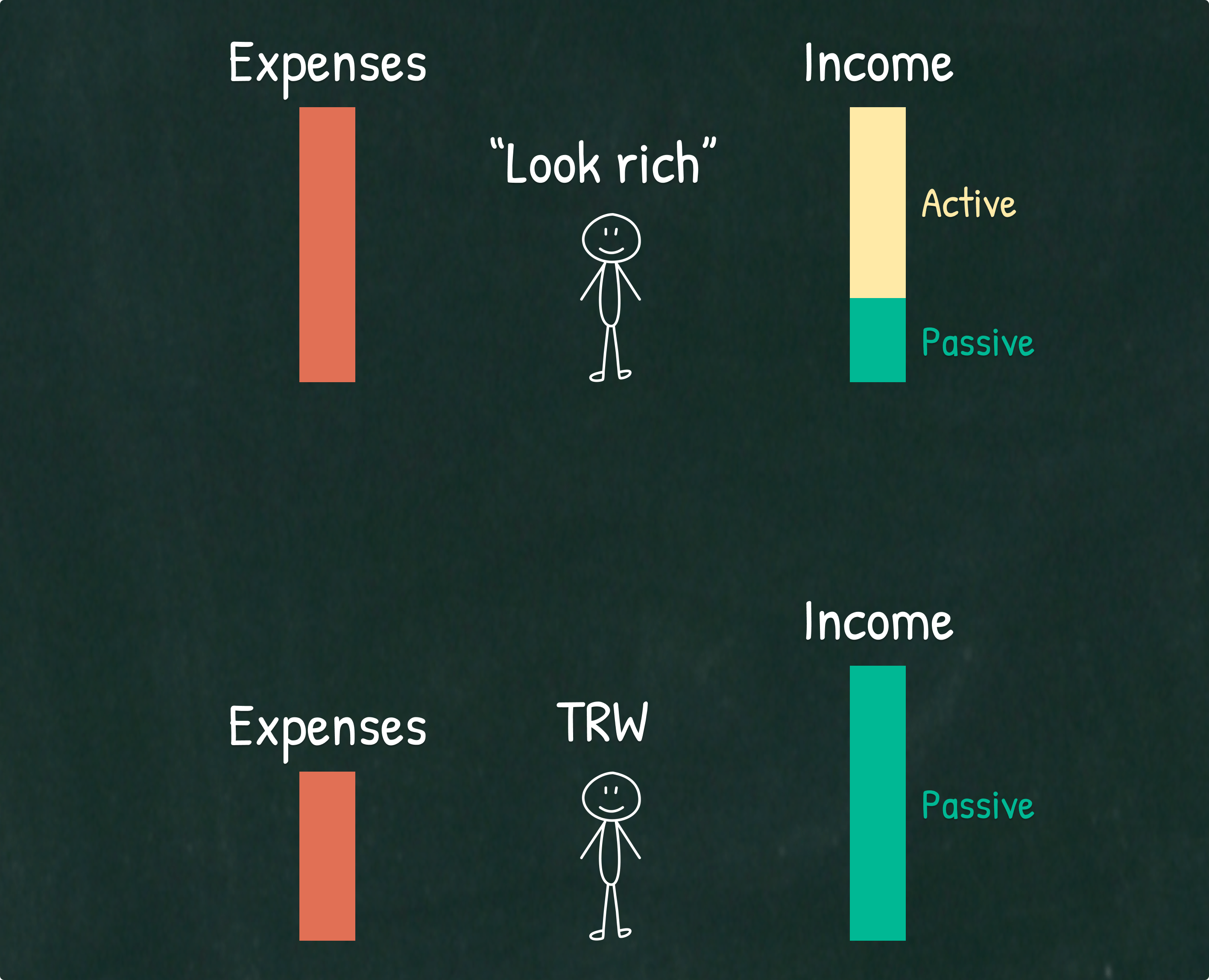

The look rich kind of person shows off a lavish lifestyle — which is not sustainable unless they keep working.

The TRW kind of person might (or might not) show off a lavish lifestyle, but one thing is always true: They can sustain it from their passive income without the need to continue to work.

What It Means To Be Truly Wealthy

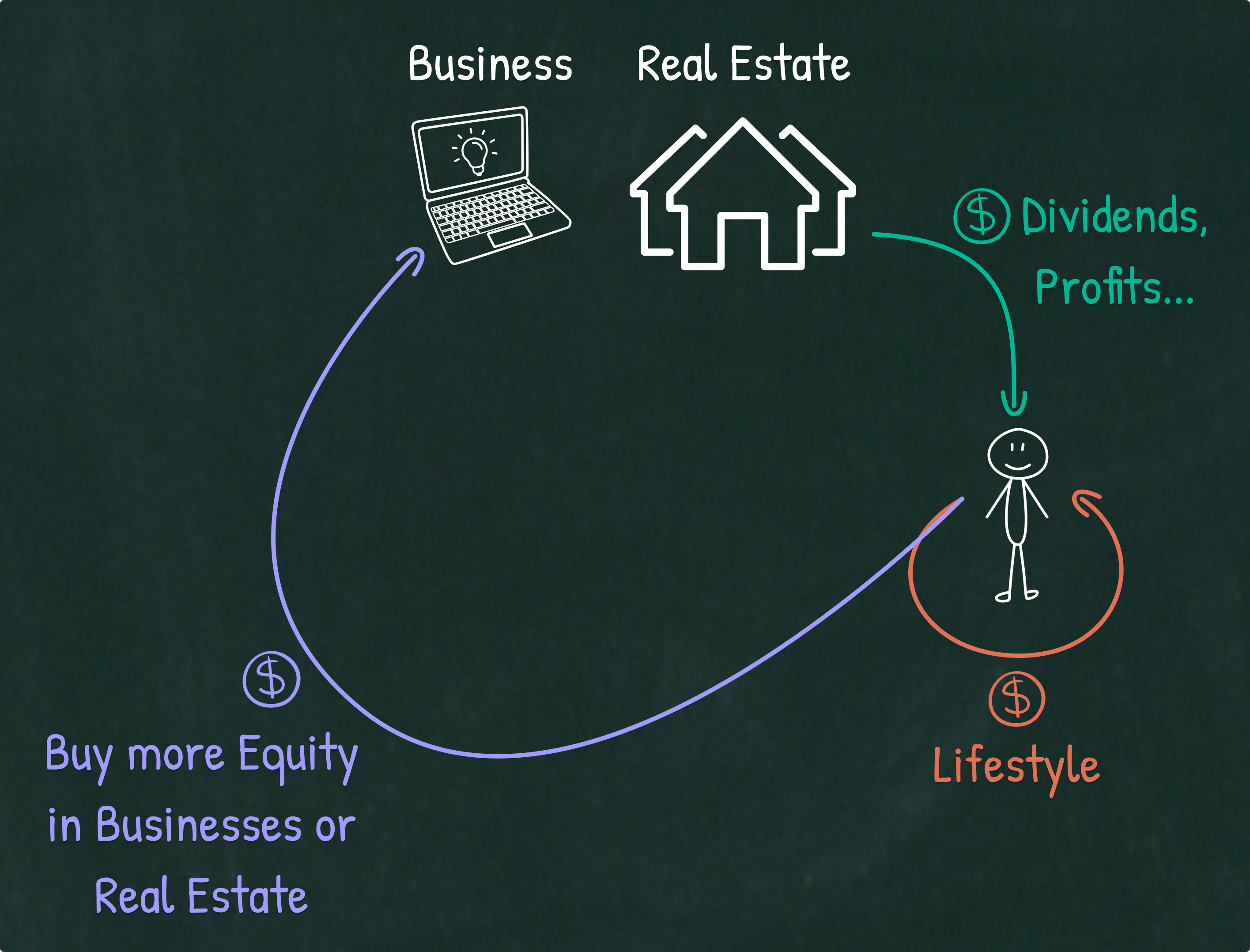

Being TRW is about having assets that can earn you money while you sleep (i.e. passive income) and which generate more net income for you than what you spend (i.e. your burn rate).

Typically, a TRW person has equity in profitable businesses or in real estate — either of which can run without their active participation. Robert Kyosaki’s “Rich Dad, Poor Dad,” the #1 personal finance book of all-time along with his game Cash Flow, encapsulated this idea.

If you want to get rich, remember that the way to do it is via equity, not salary.

– Sam Altman (Co-founder of OpenAI)

[From his Blogpost – “How To Be Successful“]

If you don't own a piece of a business, you don't have a path towards financial freedom.

— Naval (@naval) March 14, 2017

Once you have passive income that is greater than your burn, you no longer need to be the asset that makes you money. Now you have “external assets” (other than your time and effort) which are working for you! But of course, you always have the option to be an asset yourself, just not the obligation.

What It Means To Just Look Rich

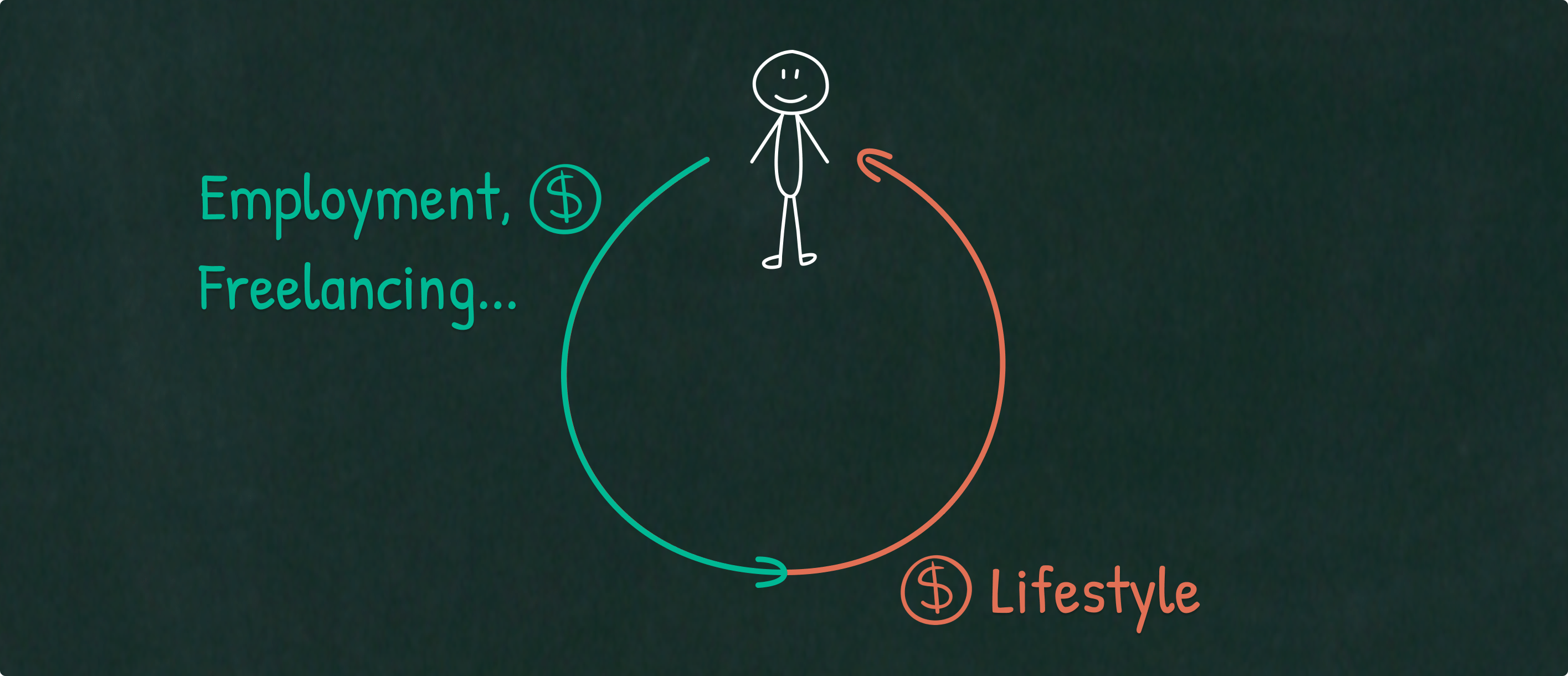

If you have to be an asset yourself to keep up with your lifestyle, then you are not truly wealthy. No matter how many mansions you have. If you need to earn your living, you are not wealthy.

On the surface, the TRW vs. looks rich distinction between people might be hard to discern, but under the surface the difference is significant: While TRW individuals have assets working for them which exceed their burn, the people who just look rich need themselves to be their own asset in order to keep up with their opulent lifestyle.

You might wonder why does it even matter how you earn the money, if at the end of the month you’ve got the same amount in-hand? Or what if the looks rich person, who works because they need to, makes more money than the TRW person who is living off of his passive income…Isn’t the looks rich person objectively wealthier?

Well, yes and no. Yes, the looks rich person might have more money than the TRW person. But are they wealthier? I don’t think so. And it’s wealth, not riches, which one wants to optimize for as epitomized by “The Parable of the Mexican Fisherman”:

An American investment banker was at the pier of a small coastal Mexican village when a small boat with just one fisherman docked. Inside the small boat were several large yellowfin tuna. The American complimented the Mexican on the quality of his fish and asked how long it took to catch them.

The Mexican replied, “Only a little while.”

The American then asked, “Why didn’t he stay out longer and catch more fish?”

The Mexican said he had enough to support his family’s immediate needs.

The American then asked, “But what do you do with the rest of your time?”

The Mexican fisherman said, “I sleep late, fish a little, play with my children, take siestas with my wife, Maria, stroll into the village each evening where I sip wine, and play guitar with my amigos. I have a full and busy life.”

The American scoffed, “I am a Harvard MBA and could help you. You should spend more time fishing and with the proceeds, buy a bigger boat. With the proceeds from the bigger boat, you could buy several boats, eventually you would have a fleet of fishing boats. Instead of selling your catch to a middleman you would sell directly to the processor, eventually opening your own cannery. You would control the product, processing, and distribution. You would need to leave this small coastal fishing village and move to Mexico City, then LA, and eventually New York City, where you will run your expanding enterprise.”

The Mexican fisherman asked, “But, how long will this all take?”

To which the American replied, “15 – 20 years.”

“But what then?” Asked the Mexican.

The American laughed and said, “That’s the best part. When the time is right you would announce an IPO and sell your company stock to the public and become very rich, you would make millions!”

“Millions – then what?”

The American said, “Then you would retire. Move to a small coastal fishing village where you would sleep late, fish a little, play with your kids, take siestas with your wife, stroll to the village in the evenings where you could sip wine and play your guitar with your amigos.”

My boy, Mohnish, touches on this here.

A Popular (Yet False) Belief on the Purpose of Wealth

Beyond covering immediate basic needs, generally-speaking, people think the purpose of money is to buy “nice stuff that makes them feel good” — or stuff which signals high status to other people.

This notion is the dirty secret which powers a consumerist society, one in which people are bombarded by persuasive advertising that perpetuates a false (and yet immensely profitable) idea: The “nice stuff” which we actually need — namely friends, freedom, and a sense of purpose based upon an analyzed life, according to Epicurus — are slyly associated with the “nice stuff” that brands want to sell us.

And it’s not only the persuasiveness of the ads that makes us believe this, it’s also the repetition of them that is persuasive!

This repetition, when combined with the fact that the average person spends precious little time being introspective about their own values and genuine desires, means it is not surprising that today’s society is so strongly consumer-driven. It’s easiest to sell to aimless people with short attention spans who are confused and lonely.

As Tyler Durden put it so well in Fight Club: “Advertising has us chasing cars and clothing, working jobs we hate so we can buy sh*t we don’t need.”

Most people overvalue the “nice stuff” in a consumerist society, because it’s nature is ephemeral!

Most of this “nice stuff” is like a sugar high. It might make you feel better, but only for a short period of time…(especially when you consider forced obsolescence).

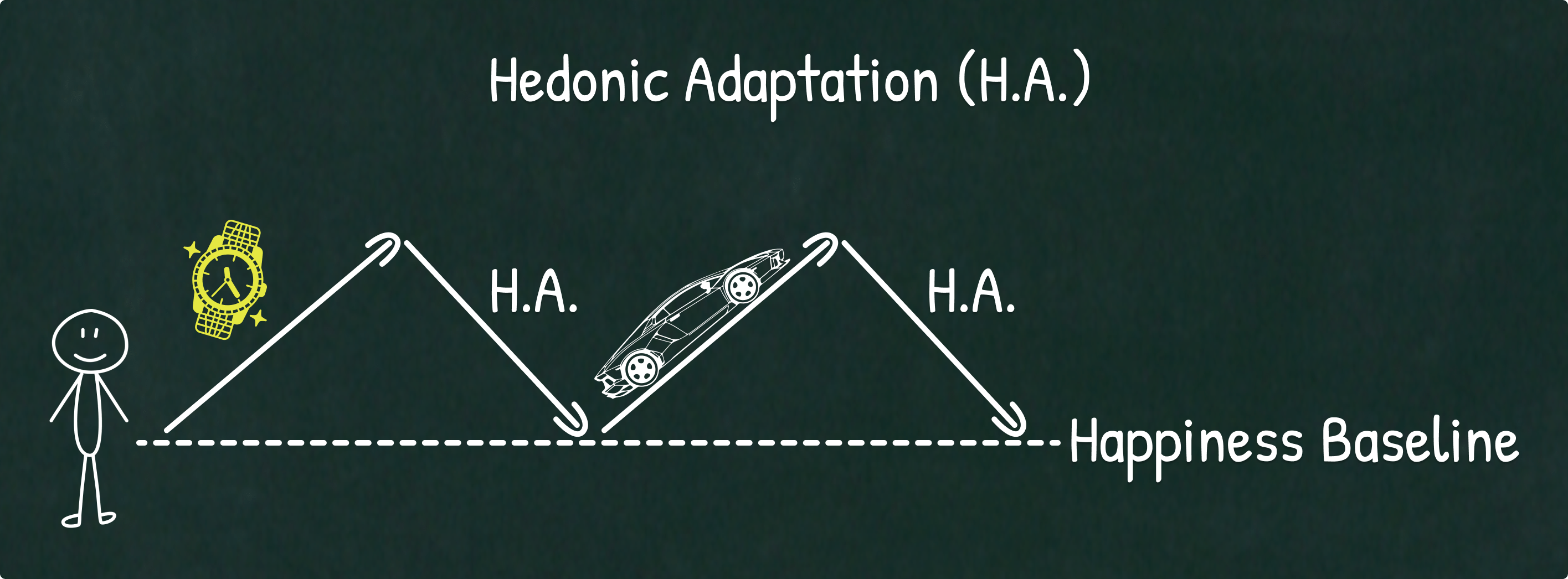

And after we’ve got our “nice stuff” in-hand, we go back to our default baseline of happiness. This phenomenon has been long researched and it even has a name: hedonic adaptation.

And if you think that the “nice stuff” you bought will make other people think better of you, that’s an illusion.

Others aren’t thinking about you when they see you with that “nice stuff,” they are thinking about themselves! The pedestrian who watches you drive by in your Ferrari with envy in his eyes is looking right through you. He’s envious of your car — and is picturing himself in it.

(Just like you are thinking about yourself when you buy “nice stuff” to signal status to other people).

This phenomenon also has an official name: The spotlight effect. The spotlight effect states that people tend to believe they are being noticed more than they actually are.

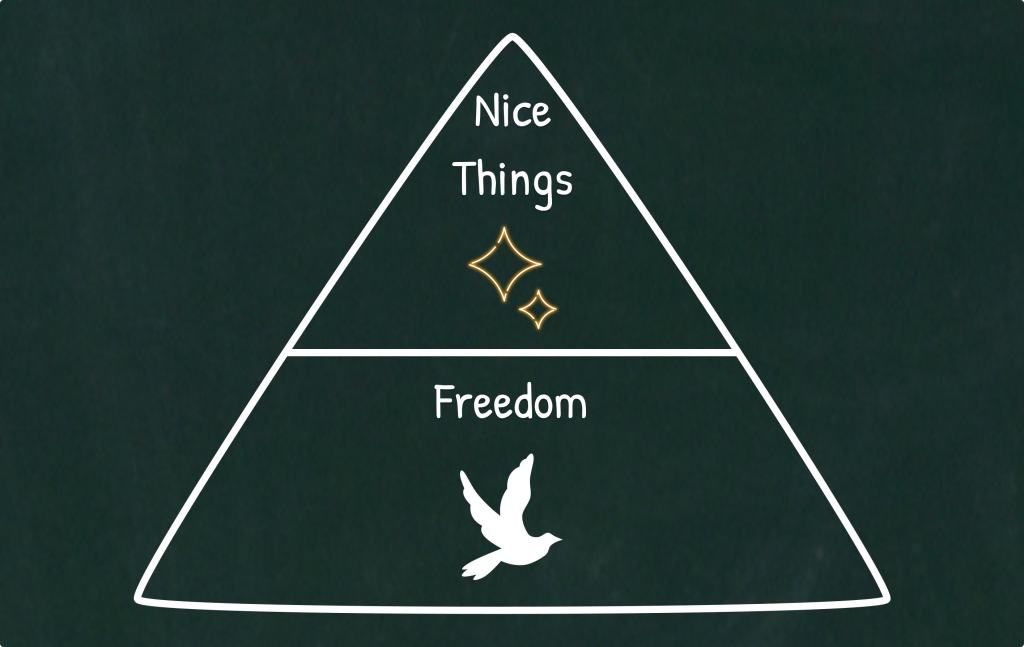

And there’s nothing wrong with buying the “nice stuff.” The trap is when (a) you think that you actually need the nice stuff and (b) you believe it is the main purpose of getting more money. The first is obviously inaccurate, and the second is incorrect because the true purpose of money is freedom.

The True Purpose of Money

Having enough income and financial worth to have the sense that you can live life on your own terms (and with the freedom to lead the lifestyle that you want for yourself and your loved ones) is not only an important element of a truly rich life, but an essential one.

– Robin S. Sharma

[From his Book – The Wealth Money Can’t Buy]

Achieving financial freedom is truly a worthy goal for any human being, and it can’t even be compared with the ephemeral pleasure of buying “nice stuff.”

So, once you secure your freedom, and you realize that the “nice stuff” is not as necessary as Madison Avenue would have you believe, you can then start to think about buying the nice expensive stuff — that is, if you still want it.

People who live far below their means enjoy a freedom that people busy upgrading their lifestyles can’t fathom.

– Naval Ravikant

[Twitter]

Financial freedom is such a worthwhile goal because once you are free, you can choose how to spend your time.

The older I get, the more I realize that true wealth isn’t about how much money you have in the bank, it’s about not having to wake up to an alarm clock.

Time freedom is the ultimate form of wealth.

Wealth isn’t about buying fancy things.

Wealth is about being able to say ‘no’ to things you don’t want to do.

– Noah Kagan

[Source: Twitter]

And once you can say no to things you don’t want to do with your time, you can use it wisely! Sahil Bloom is a great example, taking his son Roman for a swim in the middle of a typical weekday…

What I used to consider a flex:

• Flashy car

• Expensive watch

• $200 bottle of wine

What I now consider a flex:

• Being able to take my son swimming at 1pm on a Wednesday

Freedom > Everything

To go a little deeper on this issue, let me introduce a snippet from a conversation between Naval Ravikant and Joe Rogan:

[Joe Rogan]:

When people look at, particularly in Social Media, when you see someone posing in front of their mansion with their beautiful car and they’re leaning against it with their designer clothes on, their expensive watch, you go “Ahhh I want that! That’s what I want!”[Naval Ravikant]:

What you really want is freedom. You want freedom from your money problems.Essentially, what you want to get everybody to… is retirement.

But not retirement in the “I’m 65 years old sitting in a nursing home collecting a check” [kind of] retirement… Different definition:

“Retirement is when you stop sacrificing today for some imaginary tomorrow. When today is complete in and of itself, you’re retired.”

There is also a beautiful quote from (former options trader and author) Nassim Nicholas Taleb which I think captures this idea of freedom and retirement perfectly:

You become free when there is no distinction between journey and destination.#BedofProcrustes, 3rd Ed.

— Nassim Nicholas Taleb (@nntaleb) June 7, 2021

Is Wealth Really That Important?

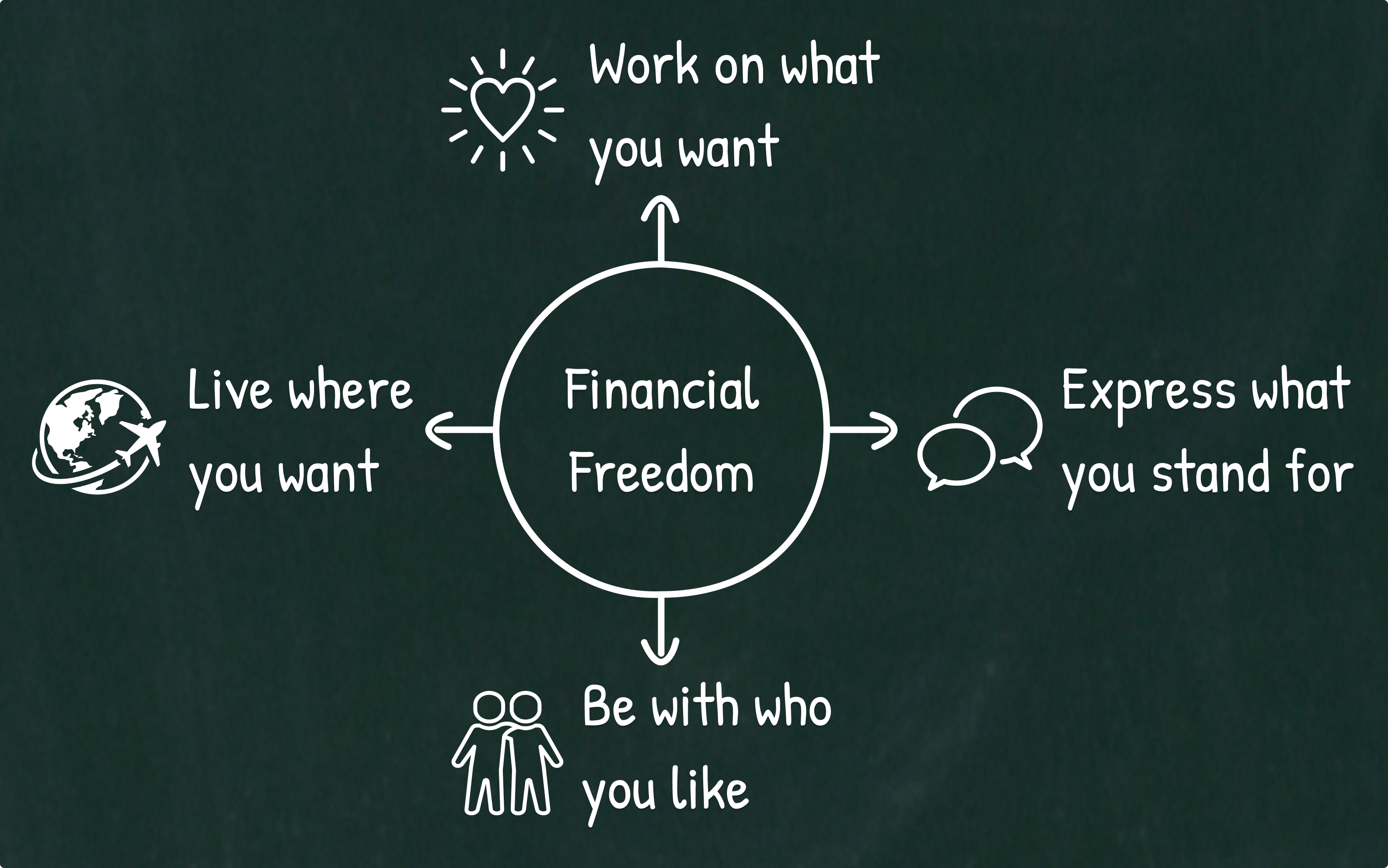

For those with an affinity for higher education, financial independence can also be thought of as being financially self-tenured. And it’s so important because it’s a means to many other expressions of personal freedom.

It’s a means to freedom to do what you find meaningful. Freedom to publicly express what you stand for. Freedom to associate with whoever you want. And freedom to live or move wherever you want.

In essence, financial freedom matters because it gives you more personal sovereignty.

Ironically, having financial freedom can also make you more likely to be even more successful. Not just because you are able to save and invest, but also because you are free to pursue what you find interesting and meaningful. And that is the recipe for doing great work, which can ultimately lead to making a lot more money!

I owe my success to my freedom.

I think for me independence has an incalculable value.

– Isadore Sharp (Founder of Four Seasons)

[Book – Four Seasons]

If you asked an oracle the secret to doing great work and the oracle replied with a single word, my bet would be on “curiosity.”

– Paul Graham (Founder of YC)

[From his Essay – “How To Do Great Work“]

On the freedom to publicly stand for what you believe, I love this quote from George Santayana:

A man is morally free when… he judges the world, and judges other men, with uncompromising sincerity.

Entrepreneur and investor, Balaji Srinivasan, has also talked about the importance of having ideological independence, as mentioned in his book The Anthology of Balaji (written by Eric Jorgenson):

Financial independence is also personal and ideological independence. If you have financial independence, the crowd can’t economically cancel you. If you have a financial cushion, which anybody can build by cutting consumption, you can ride out challenges.

….

Saving money and separating from organizations made me intellectually independent.

…

The less money you need, the less dependent you are.

People who are financially dependent can’t be fully honest because they will always have some opinions that go against the interests of their employer. From this fact, Nassim Taleb offers a wise rule of thumb:

Don’t trust a man who needs an income — except if it is minimum wage.

Now, if we invert Taleb’s rule of thumb, we have the following: One necessary element of being principled is to never get addicted to a fat monthly salary… Which is a strong addiction! And the fact that our society cherishes it does not help…

The three most harmful addictions are heroin, carbohydrates, and a monthly salary.

– Nassim Taleb

[From his Book – The Bed Of Procrustes]

What are the consequences of living in this economic dependency?

I think Jim Rohn said it best in one of his legendary seminars:

Ancient Scripts sums it all up… He said: “What if you gain the whole world and it costs you your soul?”

Too big a price to pay…

[Thus] Don’t sell out. Don’t compromise your values. Don’t compromise your virtue. Don’t compromise your philosophy.

It crushes your soul because moral corruption decreases your self-respect. And self-respect is the foundation of self-esteem.

“Don’t do things that you know are morally wrong. Not because someone is watching, but because you are. Self-esteem is just the reputation that you have with yourself. You’ll always know.”

– Naval Ravikant

The great Japanese philosopher, Miyamoto Musashi, even said: “You may abandon your own body, but you must preserve your honor.” By which he means that survival at the expense of one’s honor and integrity is not worth the cost. So now imagine what he would think of an individual that is corrupting himself not for survival, but for being able to afford his third Mercedes! I mean… that individual would qualify strongly as an anti-disciple of Musashi!

Summary Guide To Becoming Wealthy

Realize that almost everything that surrounds you has a “conflict of interest” with your personal sovereignty. It is true that businesses create positive-sum abundance for society, but much of that abundance is not worth the cost of your freedom! And the thing is, when you spend on things you don’t need, it has a double negative effect on your pursuit of freedom…

The more you spend…

(1) The less money you can save, the less money you invest, the less passive income you will get (or potential future passive income — if you invest in startups or your own business).

(2) The more you fall into the “hedonic adaptation” trap — “Chains of habit are too light to be felt until they are too heavy to be broken.” – Warren Buffet. Thus, the more likely it is that you’ll keep that lifestyle forever, and therefore your lifetime burn rate increases.

Acknowledging this detrimental dynamic is a powerful way to think twice the next time we are faced with the choice of spending on something “nice” which we don’t really need.

And the cool thing is that if instead of the word “spend” we change it with the word “save,” the previous dynamic is completely inverted! If you save more, you will increase your passive income and decrease your burn rate — which will accelerate your path towards true wealth and freedom.

Key Takeaways

- The look rich kind of people show off a lavish lifestyle — which is not sustainable unless they keep working. These people are not truly wealthy.

- The TRW – aka truly rich (or wealthy) — kind of people might (or might not) show off a lavish lifestyle, but one thing is always true: They can sustain it without needing to work. These people are truly wealthy.

- You are TRW only when your passive income is greater than your cost of living.

- The main purpose of wealth is not to buy fancy stuff, but to acquire more personal sovereignty.

If You Liked This Essay, Check Out These Sources

- Video — Kyla Scanlon interview with Scott Adams

- Website — Rich Dad, Poor Dad

- Blogpost — How to be Successful, by Sam Altman

- Video — Mohnish Pabrai on “The Parable of the Mexican Fisherman”

- Video — Epicurus on Happiness

- Book — The Wealth Money Can’t Buy, by Robin S. Sharma

- Video — Naval Ravikant on The Joe Rogan Experience

- Tweet — Becoming Financially Self-Tenured

- Book — Four Seasons, by Isadore Sharp

- Essay — “How To Do Great Work“ , by Paul Graham

- Book — The Bed Of Procrustes, by Nassim Taleb

- Video — Jim Rohn’s Seminar